Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

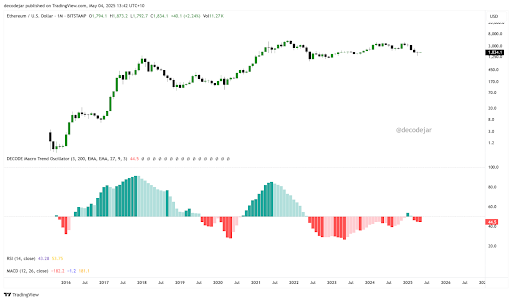

Ethereum price action May have fought To gain ground in recent weeks, but an interesting long -term macro indicator shows Signs of early recovery below the surface. In particular, an oscillator of macro trend created by a crypto analyst known as Decode on the social media platform X began to present signs of a turnaround after an unusually prolonged downward race. If it is confirmed, this would mark the start of a new phase of strength for the second largest cryptocurrency by market capitalization.

The shallow red bars begin to activate the multi-time trend analysis of Ethereum

The monthly graph of the oscillator, superimposed with the price of Ethereum on the period of monthly candlestick, clearly shows how deep and sustained the recent momentum has been. The red histogram bars reflecting the weakness of the macro persisted far beyond the typical durations, highlighting the wider economic trail that has weighed on the cryptography market.

Related reading

Interestingly, January of this year has briefly hinted at a return to a bullish territory, but the green impression turned out to be a false beginning and quickly faded while the cryptocurrency launched another slowdown. However, the magnitude of recent red bars is notably less deep compared to slowdowns in 2023 and 2024.

This subtle change is more apparent on lower time, in particular the 3 -day graph, which shows a clean rejection of the negative territory and the formation of a small green bar before the current withdrawal. The analyst, Decode, interprets this as a possible turnaround at an early stage. Once the oscillator has become green in a sustained way, a rapid rise in Ethereum and wider cryptography prices is likely to follow, after similar transitions in the past.

The green phase will soon dominate

Look beyond cryptoThe Decode oscillator also follows the S&P 500 and the wider macro trends, where the same diagram is valid: the green phases are not only more prolonged but also steep and more robust. This asymmetrical distribution of the momentum over time reflects the real bias of assets towards expansion on contraction. Decode noted that it is not simply an indicator with arbitrary thresholds but a fully integrated macroeconomic index built from 17 measures. These include shares, bonds, basic products, currency flows, the liquidity of the central bank (M2) and even feeling data.

Related reading

Translation in Ethereum, this progressive change to the green area is considered an incoming price strength signal. Although Ethereum has not yet been completely recovered from its recent correction to $ 1,400, the subtle but coherent improvement of the Decode macro-trend oscillator suggests that cryptocurrency can enter a new upward trend. Currently, the emphasis is placed on the impression of green bars regularly, in particular on several deadlines.

At the time of writing this document, Ethereum is negotiated at $ 1,830. The last 24 hours have been marked by a Brief break below $ 1,800 Before bolishing $ 1,785. This decision caused liquidations of approximately $ 35.92 million in ETH positions, with long positions representing $ 28.38 million in this amount.

Getty Images star image, tradingView.com graphic