Dogecoin’s holders (DOGE) were put into force by Crypto Ali Martinez analyst (@ali_charts), who shared a table on Monday highlighting a remarkable technical configuration. According to Martinez, the market value ratio / value made (MVRV) for Doge has just formed a “death cross” with its own mobile average (MA) of 200 days – an event which was previously in correlation with price reductions major.

DOGECOIN MVRV Death Cross Warning

Martinez’s graph, coming from Santiment, traces three key data points: the DOGE / USD price (black line), the DOGE MVRV ratio (Orange line) and the MVRV ratio of DOGE at 200 days (red line). He commented: “Doge has just seen a cross of death between the MVRV ratio and its 200 -day MA. The last two times this has happened, prices have dropped by 26% and 44%. »»

The newly printed “cross cross” occurs where orange MVRV ratio Line falls below the 200 -day red line. Historically, notes the analyst, the Doge price experienced two significant corrections after this same crossing: a drop of 26% between the beginning of September and the end of October 2023 and a dive from 44% from mid-June to the end of September 2024.

Related reading

The two slowdowns appear in shaded areas of the graph, labeled accordingly. After each of these prints, the price of Dogecoin finally rebounded, but only after having reached price levels in particular lower. Looking closely at the graph, the Dogecoin price is shown to negotiate at around $ 0.268. The MVRV report (Orange line) has climbed almost 91%, while the 200 -day MVRV ratio (red line) oscillates around 78.36%.

The MVRV ratio compares the current merchant value of Dogecoin to its value achieved (the database of the aggregate cost of DOGE has moved in chain). A 91% MVRV indicates that market players could on average be considerably compared to their purchase price – if the ratio remains greater than 1. although the exact interpretation depends on how an analyst applies the scale MVRV, a higher MVRV ratio generally involves, has increased unrealized gains among the holders.

Related reading

The 200 -day MVRV MV is the simple mobile average of the MVRV report in the last 200 days. It provides a longer-term reference base to assess how the current Dogecoin MVRV is above or below its historical trend. A “cross of death” in this context appears when the short -term MVRV report (Orange line) moves in the MVRV 200 -day (red line), often signaling a potential change in the feeling or the imminent sales pressure .

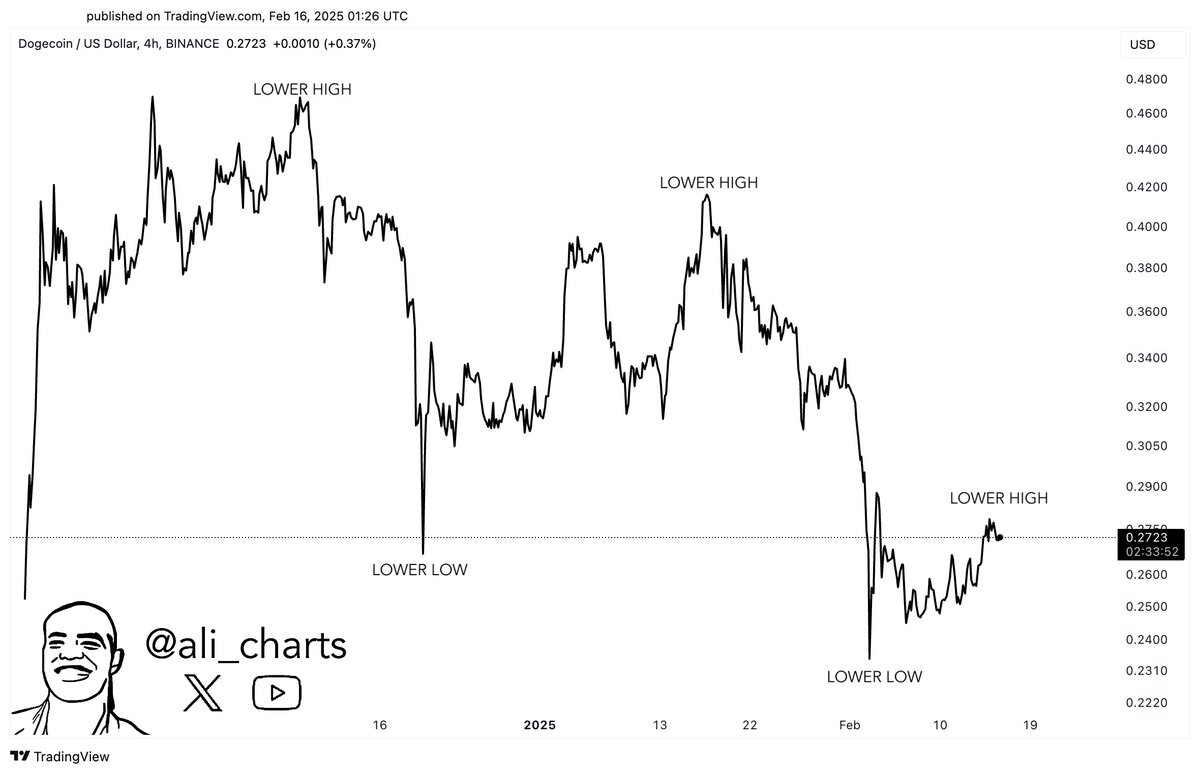

In particular, the Dogue price indicates some weakness in the past two weeks. From the summit of December 8 at $ 0.4834, Doge constantly writes lower ups and lower stockings, a very lower graphic configuration. Martinez shared the graphic below and declared: “Doge remains in a downward trend, forming lower stockings and lower ups. A break above the resistance of the keys is necessary to change the momentum! »»

To make it happen, Doge should exceed $ 0.44. However, Doge bulls Can expect significant resistance at $ 0.31 (0.382 Fibonacci retrace level), $ 0.342 (0.5 FIB) and $ 0.375 (0.618 FIB). At the time of the press, DOGE exchanged $ 0.26.

Star image created with dall.e, tradingView.com graphic