Ethereum (ETH), the second largest cryptocurrency in the world by market capitalization, is ready for a massive increase rally because it has formed an optimistic price action on the daily delay. Despite the recent drop in the cryptocurrency market in recent days, prices’ action suggests that feeling is ready to drop from a downward trend to an upward trend.

Technical analysis of Ethereum (ETH) and to come

According to an expert technical analysis, Ether has emerged from a bullish falling corner pattern that he has trained since November 2024. After the breakup, the feeling seems to have changed completely.

Based on historical price dynamics, if ETH successfully closes a daily candle above the model, that is to say the level of $ 3,400, it is possible to rise by 20% to reach The level of $ 4,100 in the future. Currently, Ether is faced with a modest resistance at $ 3,400, which could play an important role in its future earnings.

On the positive side, the relative force index (RSI) is 55 years old, which indicates that ETH has enough strength to maintain the momentum.

Metrics in mind

However, despite the escape and recent gains in the midst of market uncertainty, long -term holders and investors have poured their assets, according to the analysis on chain Rinsing. Punctual input / output data reveal that exchanges have seen a significant influx of $ 103 million from Ethereum.

In the cryptocurrency industry, Flow refers to the active flow of portfolios to exchanges, indicating a potential sale, which can result in sales pressure and an additional drop in prices.

However, not only have long -term holders showed force, but traders also bet strongly on the long side, indicating an increased perspective.

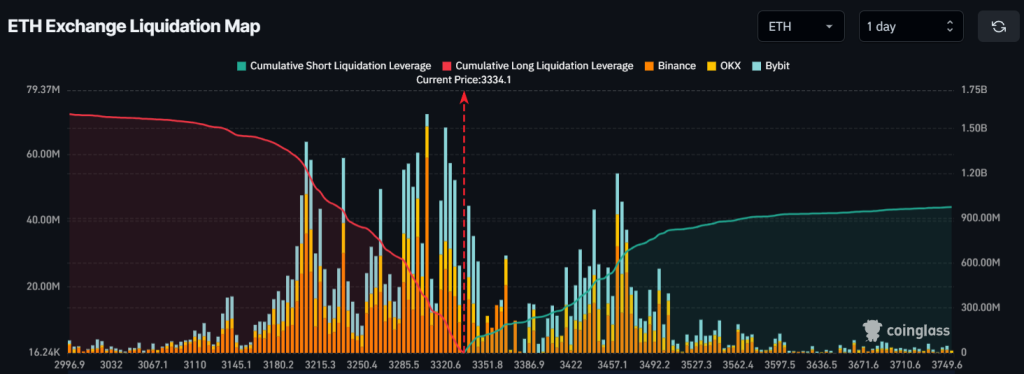

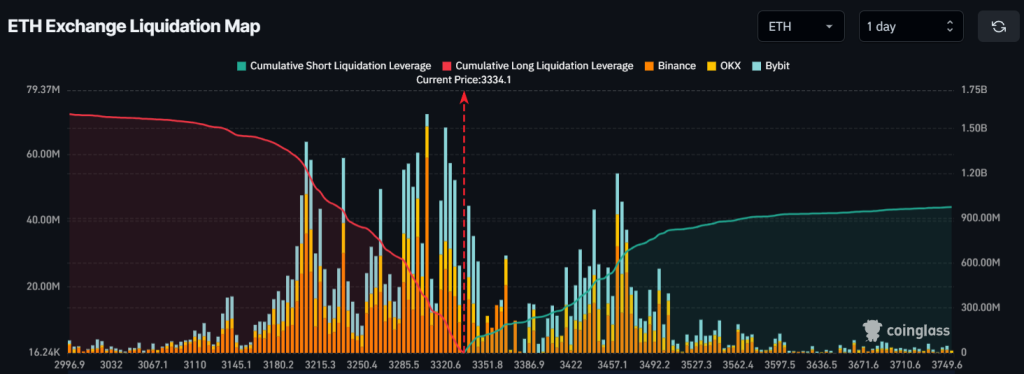

At the time of the press, the main liquidation zones are $ 3,305 on the lower side, where the bulls are over-fed and hold $ 360 million in long positions. Conversely, $ 3,370 is the level where sellers uncovered seem to be overestimated, holding for $ 190 million in exposed positions.

These chain metrics suggest that the bulls strongly dominate the assets and could support the ether to violate the resistance level of $ 3,400.

Current price momen

ETH is currently negotiating nearly $ 3,350 and has experienced a sharp increase of more than 1.50% in the last 24 hours. However, during the same period, its volume of negotiation jumped 10%, which indicates increased participation of traders and investors, potentially motivated by the recent escape.