The price of Bitcoin takes a little time “stuck” in a price range between $ 98,500 and $ 111,900. Bitcoin does not win a final address. Although Trump’s trade war and geopolitical agitation in the Middle East cause anxiety, the underlying conditions remain optimistic.

Why are the underlying conditions? Is it enough for a bull market to start? This is what we are going to investigate.

It’s very optimistic for Bitcoin

Anyone who reads the holders would expect to see panic in the financial markets. Donald Trump has been fighting the most difficult trade war for decades, the Middle East is in flames and the tensions between the great powers continue to increase. However, the markets show an surprisingly different panorama: Bitcoin quotes around their highest level in history and American bags are also moving near the record levels.

How is it possible in a world that seems so risk loaded?

The answer is under the financial conditions if called. This term refers to the general availability and the cost of money in the economy. And these conditions, despite increasing uncertainty, remain extremely favorable.

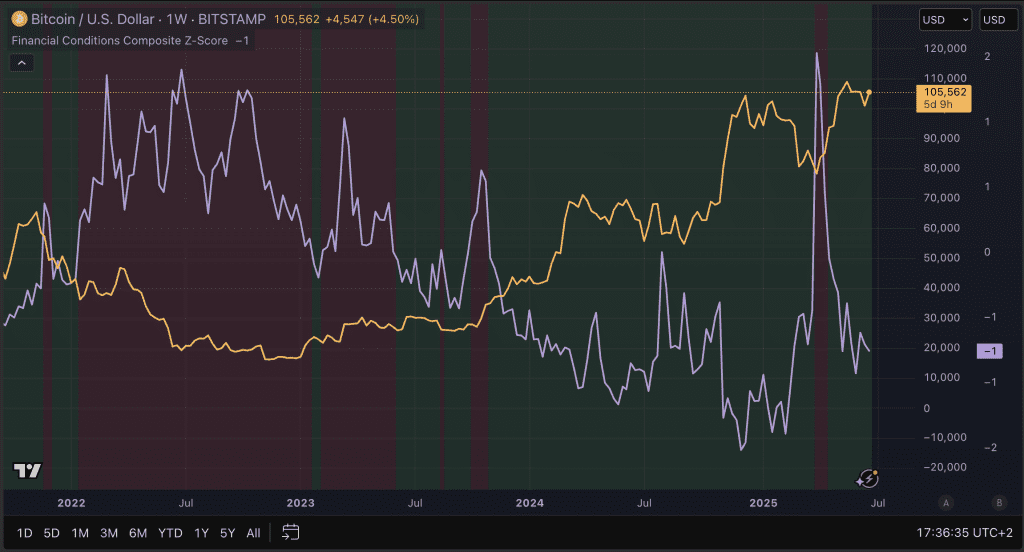

The following graph shows the movement of Bitcoin price Faced with financial conditions. A descending purple line means improving financial conditions, more money in the financial system and a better environment for Bitcoin.

These financial conditions include

- Interest rates of public debt and business loans

- The difference between interest rates of safe and at risk, also known as credit differential

- The value of the US dollar

- The quantity of liquidity available in the financial system

Together, these factors attract a panorama of ease or difficulty for businesses and consumers to borrow, invest or spend money. Currently, these conditions are wide. That is to say that money is inexpensive and widely available.

This has important implications:

- Companies can invest and develop at low cost

- Consumers continue to borrow and spend

- Investors assume the risks more easily

- Bankruptcies are still low

Above all, the abundance of liquidity, partly the result of years of flexible monetary policy, means that investments at risk, such as Bitcoin And variable income always has a request.

In addition, central banks, such as the United States Federal Reserve, indicate more and more that are approaching interest rates. This feeds expectations that money will remain inexpensive for a long time. And it is precisely the fuel with which risky investments thrive.

Although savings pay little and money is easy to make, investors will continue to seek profitability. And that explains why actions prices download, even in a world which, at first glance, radiates uncertainty above all.

Do you instantly want the latest cryptographic news? Follow us on Twitter / X