Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

The Glassnode chain analysis company has highlighted the area from $ 97,000 to $ 98,000 as important for Bitcoin. Here is why.

Bitcoin CBD suggests an accumulation of power in this range

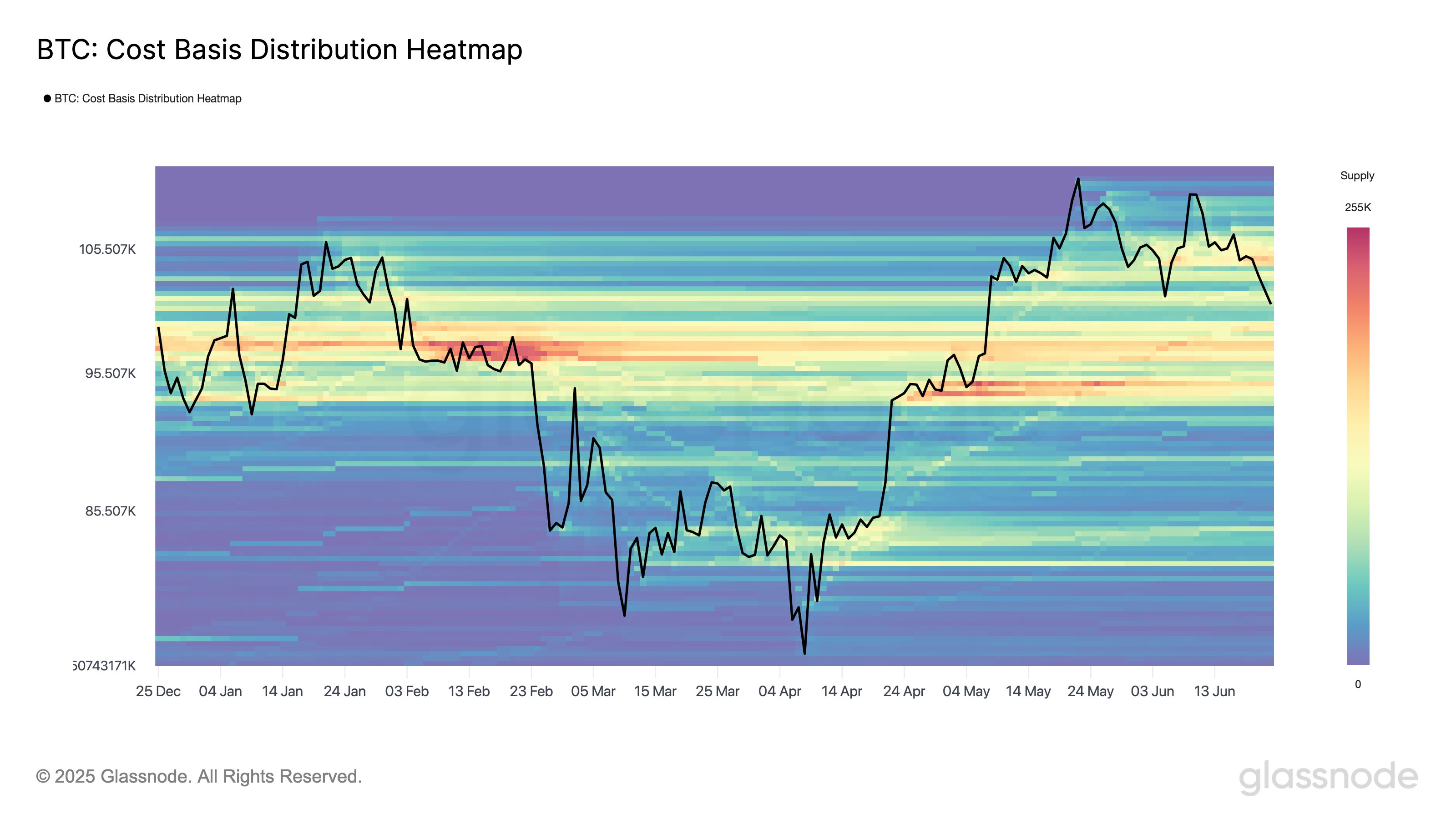

In a new job On X, Glassnode discussed a potentially significant area for Bitcoin depending on the basic cost distribution. THE Cost base distribution (CBD) is an indicator that measures the amount of the BTC offer that investors have bought or transferred for the last time to the different price levels.

As it is visible in the above graph, there is a dense supply area located between $ 97,000 and $ 98,000. Generally, investors are quite sensitive to the rewards of their cost base, therefore a large quantity (or alternately, some major holders) having their level of acquisition inside a narrow range could make the tests important for Bitcoin.

Related reading

When the atmosphere on the market is optimistic, holders can react to the retests of their cost base above by buying more. They can do it by believing that the same level would eventually prove to be profitable in the future and that the trace is only ”soak.

The cryptocurrency underwent a dive yesterday and almost touched this region. Since then, however, things have turned for the assets and she won again on the distance.

In the event that the decline continued, which may not be too unexpected given the Volatile geopolitical situation Currently, the area could end up acting as the next real pivot for Bitcoin, according to the analysis company.

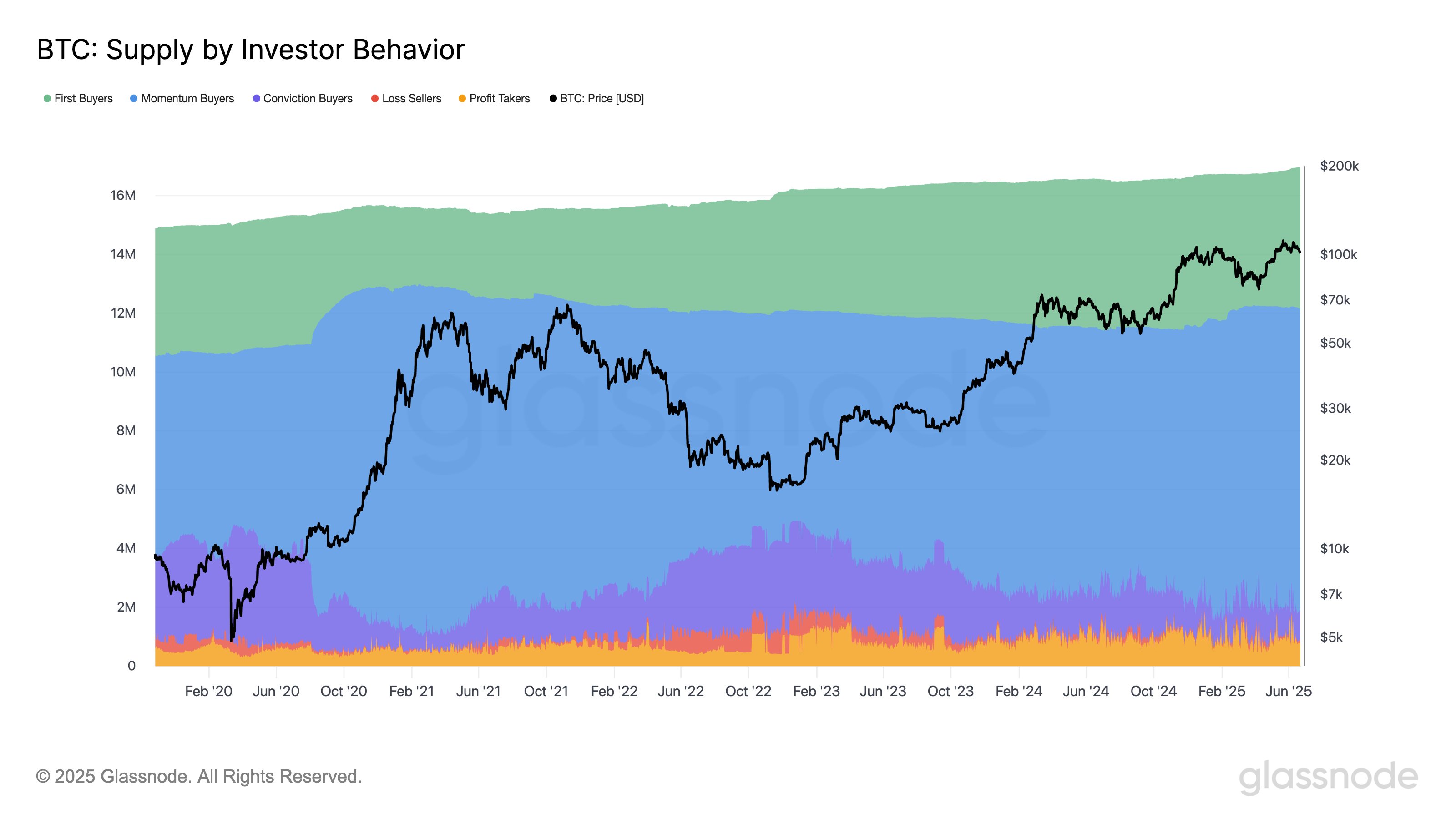

Although the CBD tells us where the cryptocurrency supply is concentrated, it does not contain any information on which has bought or sold at these price levels. Glassnod’s behavioral cohorts, groups of investors divided on the basis of their behavior, solve this problem.

Here is a graphic that shows the tendency to supply Bitcoin owned by these Cohorts Holder in recent years:

There are five of these behavior groups. The first (green) buyers include investors who buy bitcoin for the very first time. As displayed in the graph, the supply of this group has been increasing, which indicates a new request.

Enimony buyers (blue) are those who capitalize on the momentum of the market by buying during high trends. On the opposite spectrum are buyers of conviction (purple), who buy despite the drop in prices.

Finally, there are the losses of losses (red) and the takers to profit (yellow), who correspond to investors coming out respectively of a loss and a profit. In the past two weeks, the old cohort has increased 29%, a sign that weak hands capitulated.

Related reading

That said, the analytical company noted: “Buyers of convictions have also increased, which suggests that feeling does not collapse. Some reduce losses – others actively lower their cost base. ”

BTC price

At the time of writing the editorial staff, Bitcoin floats around $ 103,900, down more than 4% in the last seven days.

Dall-E star image, Glassnode.com, tradingView.com graphic