Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

The FNB Bitcoin Spot uprooted $ 2.75 billion this week, and this transport was almost 4.5 times last week by $ 608 million. Prices have exceeded $ 109,000, a summit not seen since January. Bitcoin even touched $ 111,980 on May 22. Investors stood up over the rally.

Related reading

Spot Bitcoin Etf Flows Surge

According to Wacky dataThe FNB Bitcoin Spot attracted $ 2.75 billion this week, up $ 608 million in the previous week. This big jump came while Bitcoin exceeded its top of all time in January of $ 109,000.

On May 21, investors added $ 607 million on the same day, Bitcoin reached a new peak. Then, on May 22, the room climbed to $ 111,980. These movements show money to pursue high fresh.

Ibit of BlackRock Flows Flows

Based on the reports, the ETF flows of May 23 only totaled $ 212 million, but the Ibit of Blackrock was the only one in the green. He reported $ 431 million on his own, which extended his entry sequence to eight days in a row.

Meanwhile, Graycale’s GBTC has seen $ 89 million on leave and Arkb Arkb lost $ 74 million. Investors seem to promote low and wide range of the greatest funds.

The feeling of the market is retreating

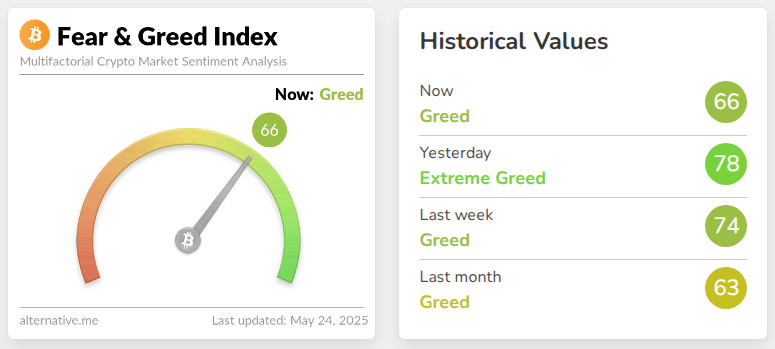

Bitcoin climb stopped a little after that. During the publication, he exchanged nearly $ 108,150. The Crypto Fear & Greed index slipped with a reading of “extreme greed” from 78 to 66, or “Greed. “This decline refers to a certain profit.

Cryptoque analyst, Crypto Dan, said on May 22 that “overheating indicators such as the financing rate and short -term capital entries remain low compared to previous peaks, and the profit by short -term investors is limited.” According to him, this rally was not motivated by risky bets.

Related reading

Save the monthly entries in sight

Until now in May, spot Bitcoin FNB attracted around $ 5.40 billion. The previous monthly summit arrived in November 2024, when ETFs took $ 6.50 billion.

With five days of negotiation in May, the entries could set a new brand. This constant request underlines how ETFs have become the essential way for many to have bitcoin without fighting with wallets and private keys.

FNB Bitcoin’s demand increased quickly. Investors like simple and regulated products. The big transmitters, led by Blackrock, have the best chance of staying at the top.

As for Bitcoin itself, if the feeling cools, prices can withdraw some. But with so strong institutional flows, many see room to run higher.

Star image of Gemini Imagen, tradingView graphic