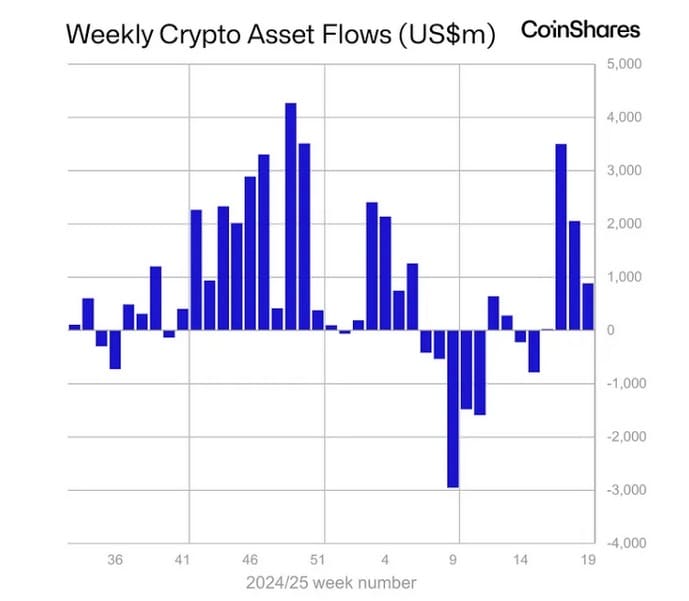

Much money flows again to several crypto exchange funds from the main asset managers. A combination of factors suddenly, the cryptocurrency market will be attractive again.

Where does this renewed interest come from?

Tickets in the main funds

The cryptocurrency funds (ETF) of the big players, such as Blackrock, Bitwise, Grayscale and 21Shares, recorded tickets of around 880 million dollars last week:

As we can see, this is the fourth consecutive week of net tickets, although the first is a little careful. Annual net tickets are now located at 6.7 billion dollars, almost the maximum reached in February of this year, or $ 7.3 billion.

James Butterfill wrote on Monday that he could appoint a series of reasons for this sudden return to the popularity of the cryptocurrency:

“I believe that strong prices and entry gains are due to a global increase in money Bitcoin as a strategic reserve. »»

Bitcoin It increased by around 10% last week, while the 30 main ones increased by around 22%. Total investments in managed funds amounted to $ 170,000 million, also on the way to a new record.

SUE BOOKS FUND

SUP scholarships contributed to tickets worth $ 11.7 million, while Solara Tickets “only” recorded worth $ 3.4 million. The SUP scholarship funds provided tickets worth $ 84 million this year, exceeding Solana, which recorded $ 76 million.

In the United States, $ 920 million has entered species Bitcoin exchange funds. In the rest of the world, these exchange products have actually lost money. The American ETF also broke a record: in total, all funds have $ 62.9 billion by boat, exceeding the previous record of $ 61.6 billion in February 2025, according to Butterfill.

Although the price Ethereum increased sharply last week, there was in fact a big start in Ethereum ETF in the United States. In other countries, however, tickets were recorded, so net tickets amounted to 1.5 million dollars.

Do you instantly want the latest cryptographic news? Follow us on Twitter / X