The cryptocurrency market is prepared for a large advance: the possible arrival of dozens of new products cited on the stock market intended to make the investment in cryptocurrency more accessible.

These are the calls Cited funds (ETF), investment fund following the price of one or more cryptocurrencies and can be negotiated on the stock market, such as shares.

FNBs are considered a bridge between traditional financial markets and the world of cryptocurrencies.

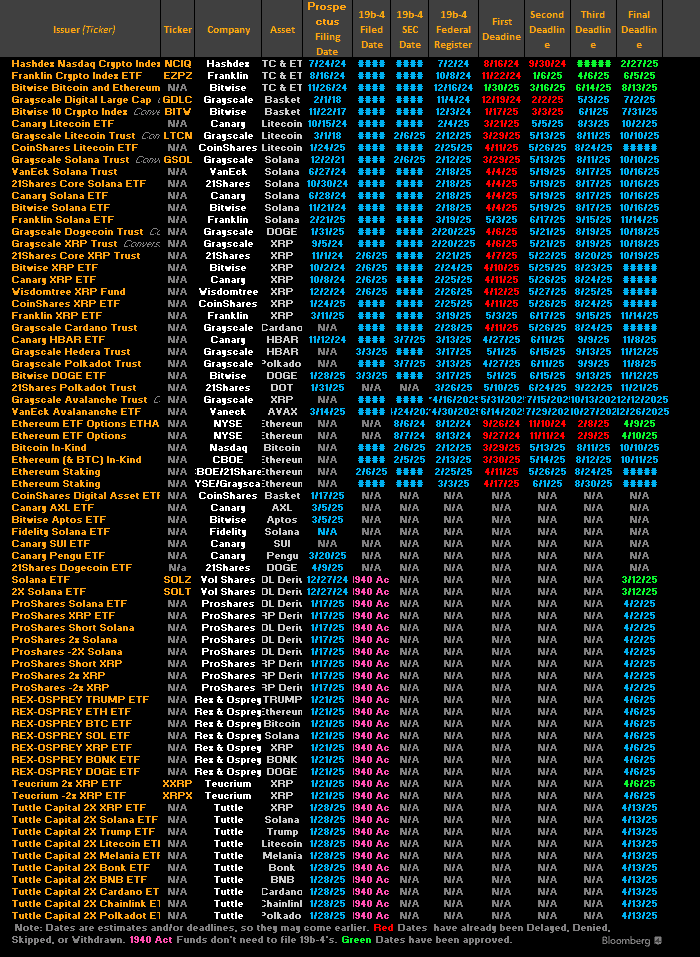

72 applications for cryptocurrency ETF before the dry

Interest in this type of product has shot in recent months. Up to 72 requests are at the table of the United States Stock Market Commission (SEC).

Eric Balchunas, Bloomberg analyst, share a Preview of all waiting applications. Among them, there are FNB requests from Litecoin (LTC), Xrp (XRP), Cardano (Ada), Solara (Sun) and included same as Mastiff (Doge), among others.

“It will be a wild year,” concludes the analyst.

The legal status of each cryptocurrency has an important role

Analysts speak of a turning point: if altcoins such as Solana, XRP or Cardano can also be negotiated via an ETF, the adoption of cryptocurrencies could accelerate considerably.

When assessing these applications, SC takes several factors. An important is the legal status of the underlying cryptocurrency. If a motto is classified as value (Effect), stricter rules are applied and the approval of an ETF is much less obvious.

Currently, Bitcoin is widely recognized as a commodity (merchandise) and is supervised by the Commodity Futures Trading Commission (CFTC). Ethereum is in a gray area, but as the dry approved several ETF in cash on Ethereum at the beginning of 2024, it is believed that the currency is treated as a commodity in practice. However, an official statement is missing.

In the case of other currencies such as Solana, Cardano and XRP, the situation is more delicate. The legal debate on its classification as values or raw materials remains open, and this uncertainty complicates the possibilities of approval by the dry.

In addition, the structure of the market also influences. Among other things, the SEC pays attention to the liquidity and transparency of the underlying currency. The higher the negotiation volumes, the more active, the more an ETF will be approved. Bitcoin and Ethereum meet this requirement from afar, but many altcoins are still late.

Finally, price manipulation remains one of the main concerns of the regulator. The dry wants to ensure that the negotiation centers are properly supervised and that they cooperate effectively with the regulatory authorities. Without this guarantee, requests are rarely approved

The launch of an ETF does not guarantee success

Despite the high number of ETF applications in Altcoin, it remains to be seen if there will be a lot of interest for them for the market. In fact, according to Balchunas, the launch of an ETF offers no guarantee of success:

“Seeing your motto transformed into ETF is like being in a music group and your songs end in all musical streaming services. This does not guarantee listeners, but puts your music where the majority of the public are. ”

Meanwhile, the first ETF of Ste Solana was launched in Canada. However, it is too early to say anything about the interest of investors. The value of the total assets managed currently exceeds $ 6 million, According to useful investments.

Do you instantly want the latest cryptographic news? Follow us on Twitter / X