Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

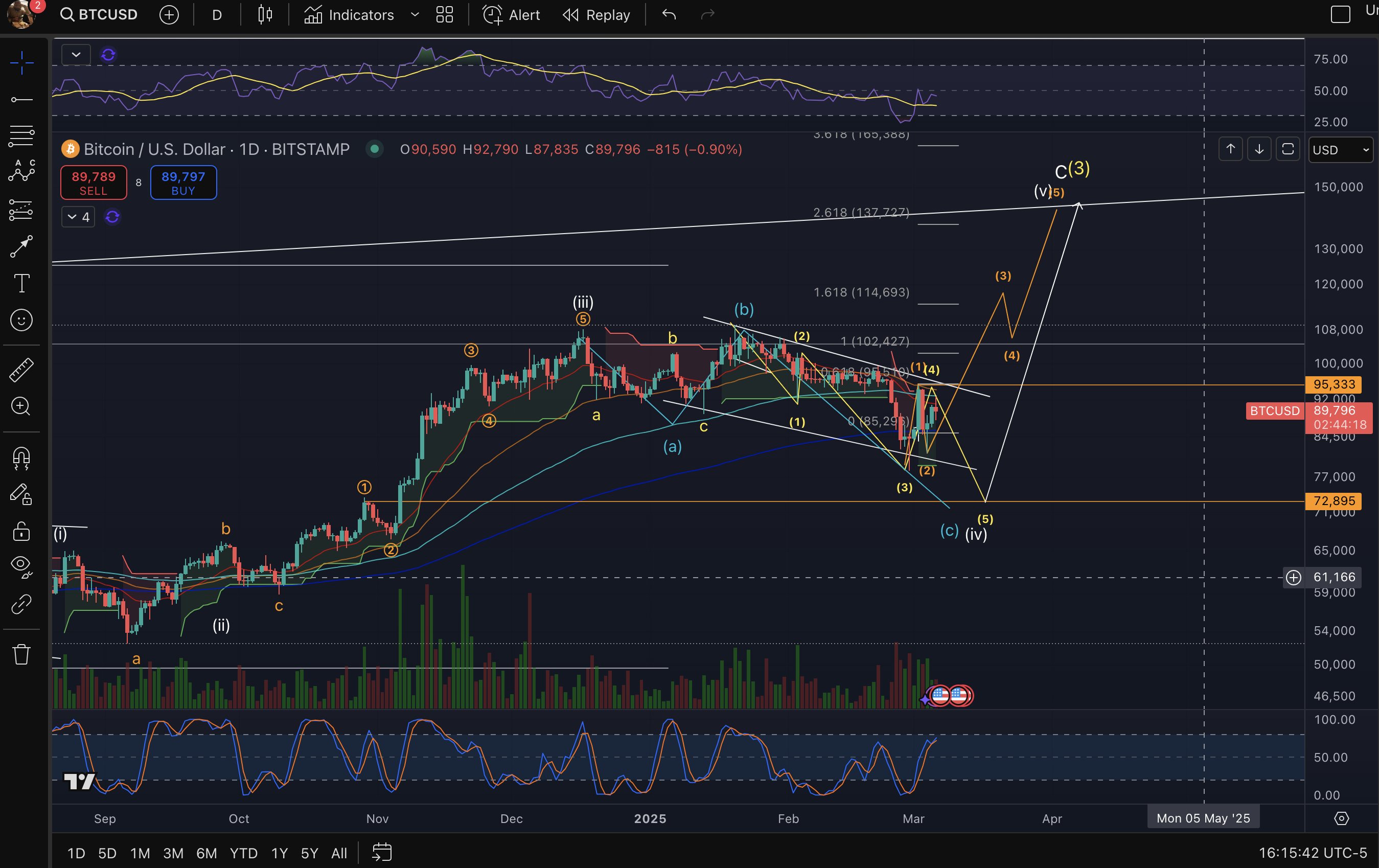

In a newly published graph, the specialist in Elliott waves and cryptographic analyst Big Mike (@Michael_ewpro) describes a precise roadmap for the action of Bitcoin prices, indicating that a break above $ 95,000 – or a rebound of more support almost $ 72,895 – could offer BTC to the region from $ 130,000 to $ 140,000. Its analysis is based on detailed wave enumerations, several targets of fibonacci extension and averages for critical moving, offering a granular overview of the possibilities near and mid-term of the BTC.

What is the next step for Bitcoin?

Big Mike graphic displays A complex Elliott wave structure composed of five main pulse waves and interspersed corrective sub-la-lane. A key area labeled nearly $ 72,895 corresponds to the wave (C) (IV), representing a major potential background if the market breaks down below $ 78,000 and continues below.

Notable corrective waves around $ 85,000 at $ 95,000 seem to have formed a greater consolidation phase, which he considers a precursor to the following directional movement. The graph also identifies an increase of $ 95,000, projecting pulse waves (3), (4) and (5) which extend in the $ 100,000 area to $ 140,000.

Related reading

Fibonacci extension targets appear at around $ 114,693 (extension of 1.618) which could be the target of the wave (3), followed by a corrective movement at $ 102,000 before starting wave 5 which aims for $ 137,727 (extension of 2.618), or even a slight slight light almost $ 150,000 alignment with the C (3).

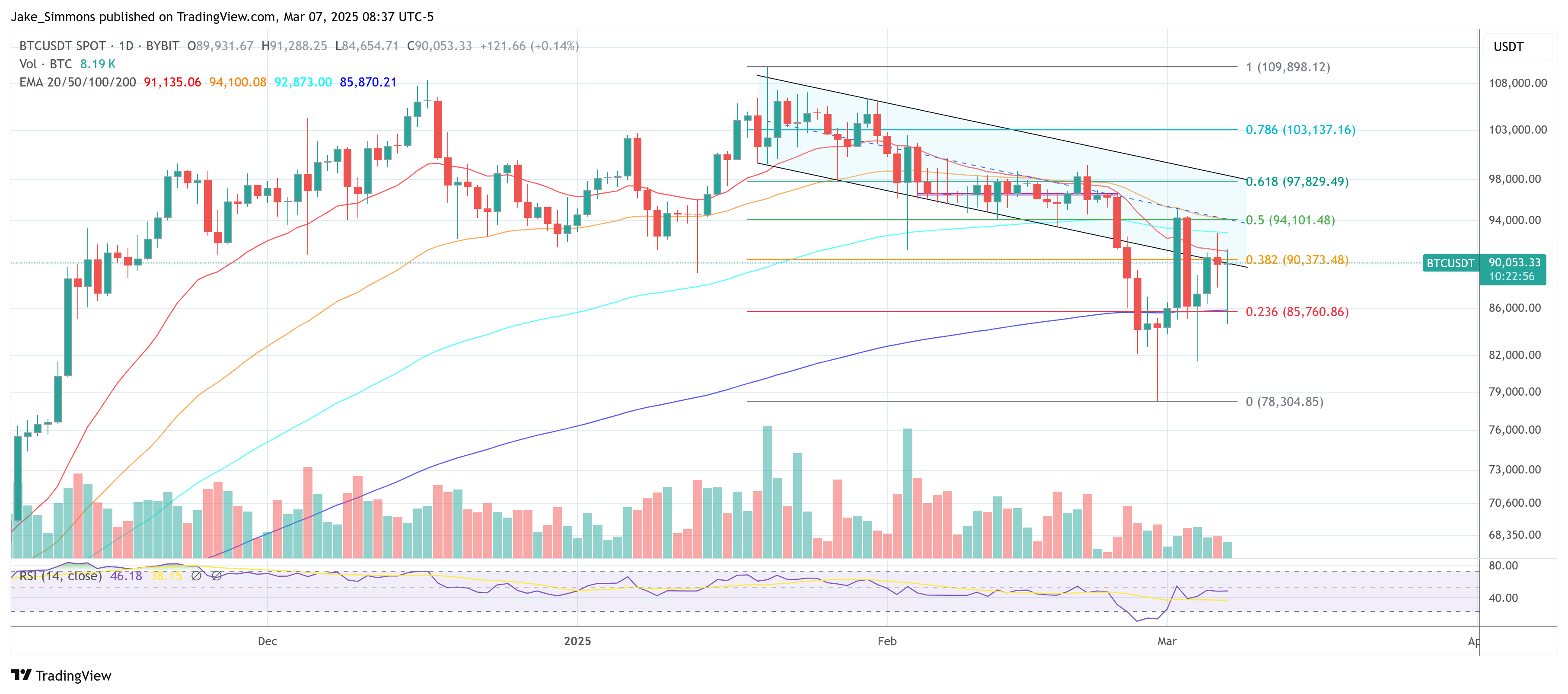

The displaced averages of the range of $ 72,000 to $ 90,000 highlight the importance of support close to $ 78,000 to $ 72,895, while a band higher of $ 90,000 at $ 95,000 represents a crucial resistance corridor. The analyst observes a formation of corner descending from mid-February to the beginning of March, extending over $ 95,000 to $ 85,000, and notes that an upward escape could announce a renewed push in a six-digit territory.

Related reading

The volume profiles indicate a moderate participation during the recent corrective phases, alongside a neutral stochastic RSI reading that suggests The momentum could change Definitely depending on the price threshold gives way first.

Big Mike emphasizes two critical lines in the sand: “BTC above $ 95,000 will quickly trigger the movement to my goal from $ 130 to $ 140,000. Below $ 78,000 and we test $ 72,000, then drop to $ 140,000. From his point of view, a direct break greater than $ 95,000 and a deeper drop to $ 72,895 ultimately converge on the same target Nearly $ 130,000 at $ 140,000.

At the time of the press, BTC exchanged $ 90,053.

Star image created with dall.e, tradingView.com graphic