Cardano (ADA) recently experienced an impressive recovery of almost 4%. However, the price now seems to evolve towards a retain for support for the ascending trend line. This drop is motivated by the feeling of the lower market and the recent robbery experienced by Bybit.

Cardano (ADA)

As the ADA price approaches the level of support, it becomes crucial to see if the asset will hold this level. If the market does not undergo a massive sale, the price can stabilize. However, if the sales pressure increases, the market will probably continue this trend until the feeling changes.

ADA technical analysis and future levels

According to an expert technical analysis, ADA Always holds its increase in increase as long as it is negotiated above the ascending trend line or the $ 0.73 bar. Looking at the daily deadlines and four hours, ADA seems to form a cup and upward handle motif with an upward triangle motif, strengthening its upward perspectives.

Based on recent price action, ADA could soon reach the level of $ 0.85 once it crosses the bar of $ 0.78. However, given the current feeling of the market, if ADA falls and closes a four -hour candle below the level of $ 0.74, we could attend a high sale and a notable price drop of 10%, which brought her back to $ 0.65.

Currently, the asset is negotiated below the exponential mobile average (EMA) over the four -hour period, which indicates that it is still in a downward trend. Meanwhile, his average directional index (ADX) is 12, suggesting a low trend force, which could be a key reason why Ada failed to rally.

Current Momentum of Prices and Surrendent Levels

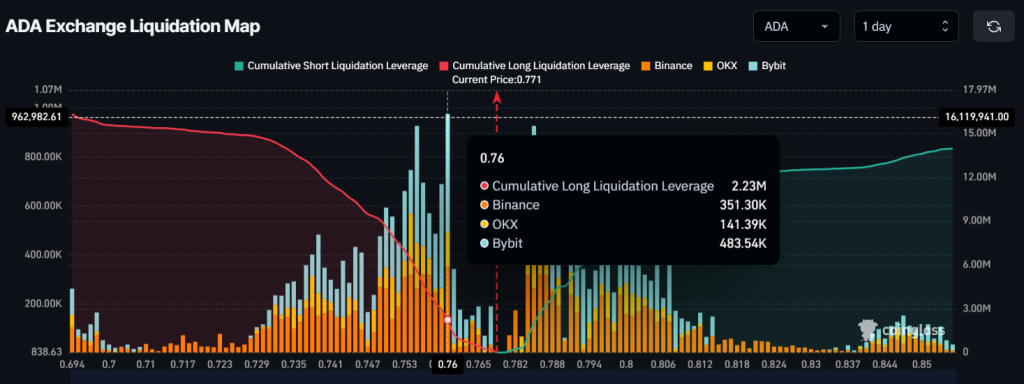

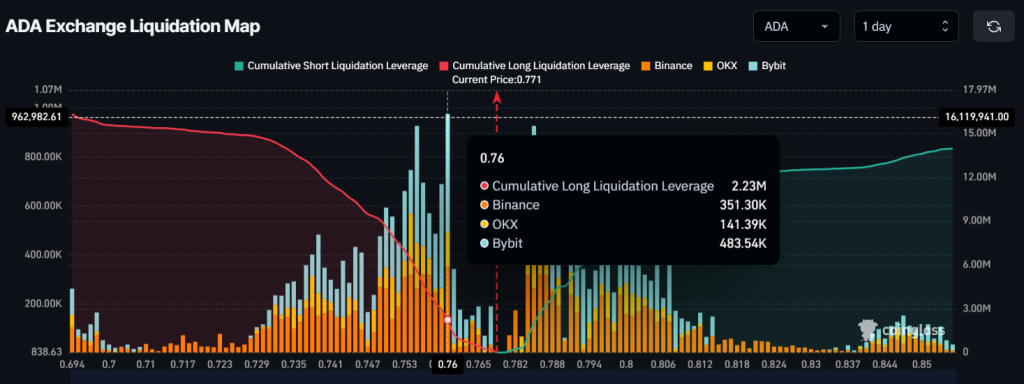

By looking at the current feeling of the market, intrajournal traders are overvalued In terms of $ 0.76 on the long side, with $ 2.23 million in long positions. Meanwhile, the level of $ 0.785 is another equity area where Paris merchants on the short side built for $ 2 million in short positions.

By examining these over-exposed positions, it seems that the bulls dominate, which could help the price of ADA above the crucial trend line.

ADA is currently negotiating almost $ 0.77 and has experienced a modest price overvoltage of 0.50% in the last 24 hours. However, during the same period, its volume of negotiation fell by 50%, indicating fear among traders and investors, resulting in a drop in participation in relation to the day before.