According to an X job By Crypto Ali Martinez analyst, Bitcoin (BTC) attends a drop in sales pressure, indicating that a background of the local market could soon be formed for the first cryptocurrency.

Local Bitcoin Bottom on the horizon?

Bitcoin continues to be negotiated just below the psychological level of $ 100,000, oscillating at $ 98,650 when writing the editorial’s time. However, the upper cryptocurrency by market capitalization constitutes a significant drop in sales pressure.

Related reading

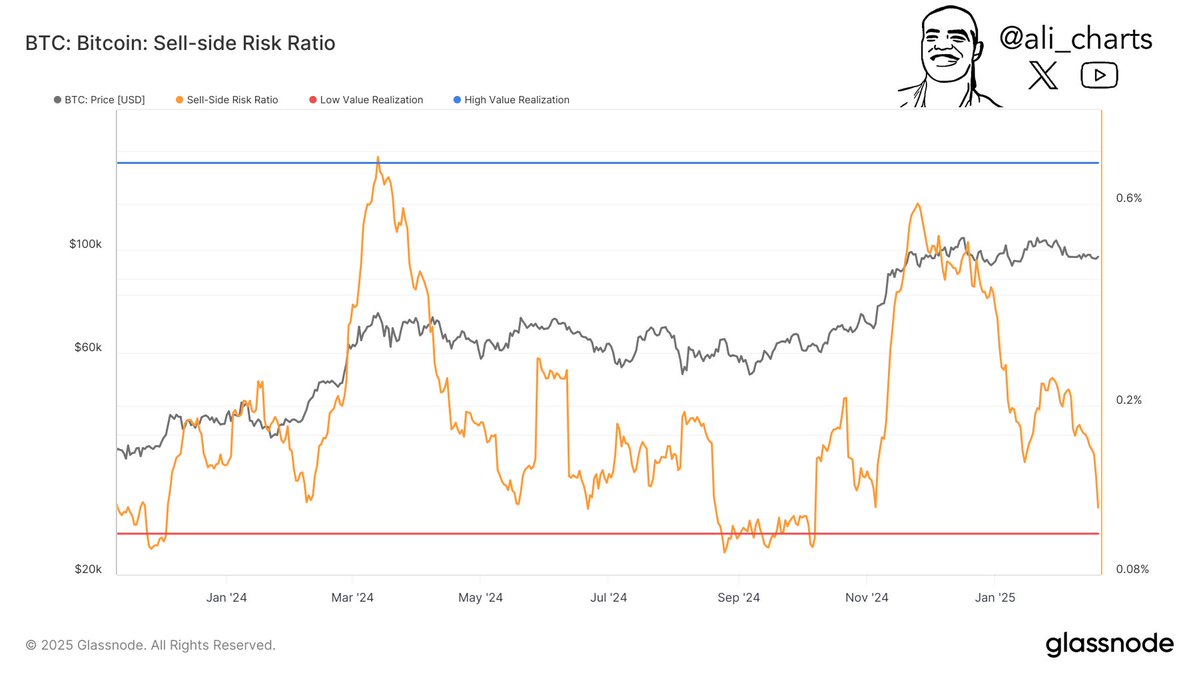

Martinez shared the graphic of the risk sales risk selling ratios according to the Crypto Analytics Glassnode Crypto Analytics platform, highlighting a sharp drop in metric since mid-January 2025. This decrease suggests that BTC could form a low local price, which has led to a new phase of accumulation of accumulation, which could potentially lead to a new phase of accumulation of accumulation, which can lead potentially to a new phase of accumulation of accusation, which can potentially lead to a new phase of accumulation of accumulation, potentially leading to a new phase of accumulation of accumulation, potentially leading to a new phase of accumulation accumulation, potentially leading to a new phase of accumulated accumulation.

For those who are not familiar, a downward sales risk ratio generally indicates that investors keep their BTC rather than selling, signaling the first stages of an accumulation phase where prices can stabilize or start to increase .

Martinez’s analysis alignments with the theories of the broader cryptography market cycle, which suggest that market funds are often followed by an accumulation phase. This phase, in turn, opens the way to a potential prices increase.

However, BTC must maintain key support levels above to confirm these perspectives. Rekt Capital Cryptographic Analyst weighed In the action of Bitcoin prices, stressing the importance of a weekly fence greater than $ 97,000 to maintain its lowest level of support.

The analyst shared a weekly Bitcoin graphic, noting that although BTC has seen several locks below its symmetrical triangle structure, the overall bullish model remains intact. However, not to close above $ 97,000 over the weekly time could increase the risk of more downwards.

Likewise, the colleague Analyst Daan Crypto Trades shared an upward perspective, stressing that BTC recently had a “solid rupture” of a descending channel structure. The analyst added::

Just see the continuation now in the weekend to get a good base in next week. $ 98,000 is the short -term key.

Is BTC ready for a new summit of all time?

While Martinez suggests that BTC can form a local background, other analysts think that cryptocurrency is gear For a step beyond $ 108,000, to reach a new summit of all time (ATH). Analyst Kevin, for example, predict That a short pressure could propel the BTC at $ 111,000.

Related reading

Likewise, a recent analysis by Rekt Capital strengths That BTC shows the first signs of a bullish divergence which could break the price of the lowering price of the digital asset. At the time of the press, BTC is traded at $ 98,650, up 0.1% in the last 24 hours.

Star image of Unplash, X graphics and tradingView.com