In the middle of the uncertainty of the current market, while the majority of cryptocurrencies attend prices resumption, Litecoin (LTC) is ready for a massive price drop. The potential reason for this lower speculation is the formation of a negative price action and the lowering feeling of traders, as reported by the Coinglass chain analysis company.

Current price momen

LTC is currently negotiating nearly $ 127 and has dropped by prices of more than 6% in the last 24 hours. During the same period, its volume of negotiation decreased by 23% due to its downward price dynamics, indicating a lower participation of traders and investors compared to previous days.

Technical analysis of Litecoin (LTC) and price prediction

According to an expert technical analysis, Thal seems to be lower because it was moving in a parallel channel model between $ 95 and $ 141 since November 2024. Despite the feeling of the lower market in recent days, the LTC price has jumped almost 38%, going from $ 95 at $ 141. However, it now undergoes the pressure of the sale due to its history of lower prices and the current feeling of the market.

Based on historical models, if LTC fails to exceed the level of $ 141, there is a high possibility that it can drop by 25% to reach the level of support of $ 95. Currently, the asset is negotiated above the exponential mobile average (EMA) on the daily time, which indicates that the LTC is in an upward trend.

Mixed metrics on the channel

When examining the current feeling and price of the market in terms of inversion, intraday traders seem to bet on the bearish side, as reported by the chain analysis company Rinsing.

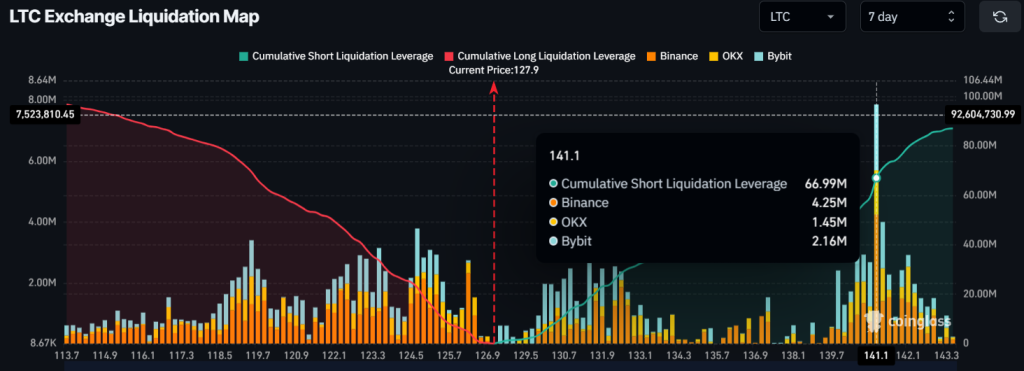

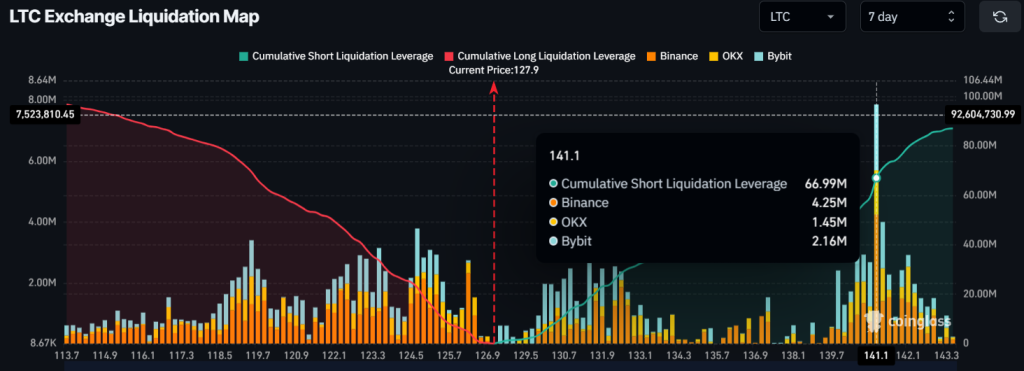

The data from the exchange liquidation card show that Paris merchants on the short side are over-designed at $ 141.5 and built a short value of $ 67 million in last week. Meanwhile, Paris traders on the long side seem exhausted, having built only $ 21 million in long positions.

These oversized positions reflect the feeling of short and long traders, because some believe that the price will not exceed this level. If this is the case, these positions will be liquidated.

Despite LTC’s lower prospects, long -term investors and holders seem to accumulate the token. The Flow / OUT Spot Data Sweep reveal that the exchanges have experienced a flow of $ 9.41 million in LTC tokens in the last 24 hours, indicating potential accumulation.

During the combination of these chain metrics with a technical analysis, it seems that short -term players are downgraded, expecting the price to decrease in the coming days. Meanwhile, long -term holders seem to benefit from the drop in prices and considerably accumulate the token.